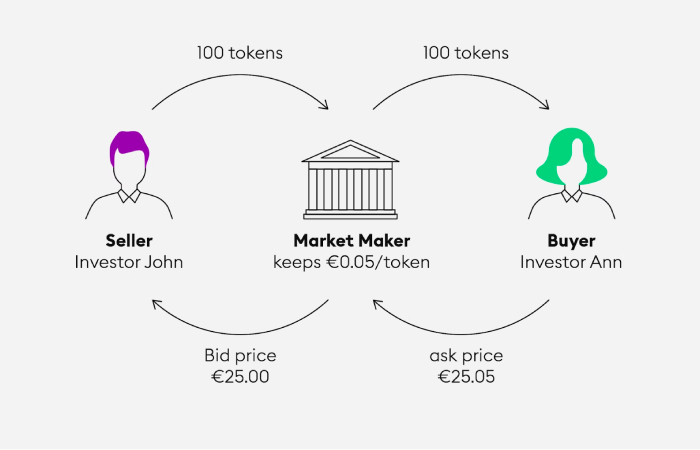

Crypto Market Maker: Crypto market makers facilitate the availability of crypto assets in the market. They help bring buyers and sellers to the market and create liquidity for each token. In addition, good crypto market makers also run algorithms to facilitate efficient trading, while also ensuring a consistent spread. These services can be offered as cloud-hosted or installed on a client’s premises.

To determine the quality of a crypto market maker, ask about its strategies, as well as its reputation. You should also look for specific metrics, as these can help you identify whether the provider is meeting your needs. A good market maker will be able to help your token get listed on a higher-tier exchange, while also facilitating liquidity and helping to build a liquid and stable token price.

Table of Contents

Crypto Market Makers are Private Firms

Market makers work in conjunction with crypto exchanges to ensure the order book is healthy. This helps reduce volatility, minimizes operational expenses, and facilitates liquid trading. Most market makers are private firms, such as hedge funds or brokerage houses. Typically, they will commit to a number of trades, a bid-ask spread, and a minimum depth. It is important to find a market maker that has a strong track record, though.

Token Gain Traction

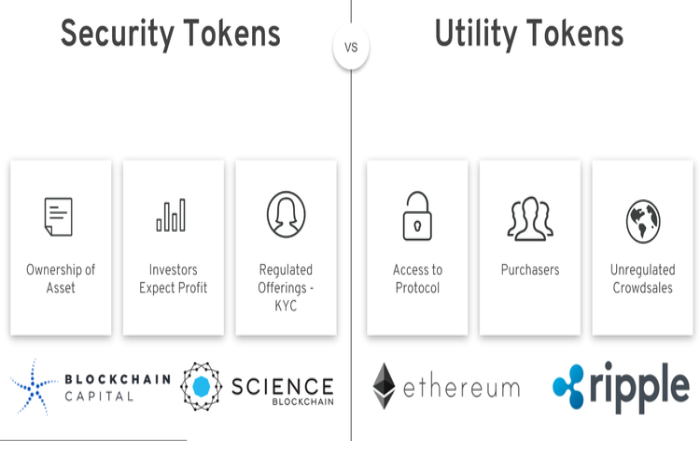

Token gain Transactions have security tokens and also utility tokens. While a good market maker can help your token gain traction, it is also important to keep in mind that there are many bad ones. Bad market makers engage in price manipulation, which can lead to a variety of negative consequences for both issuers and traders. Even worse, they can damage the reputation of a token.

Price manipulation is a criminal offense in regulated markets, as it can erase confidence in a traded asset. Additionally, it can create a compound effect on relationships with crypto exchanges and investors.

The Best Market Makers

Generally, the best market makers will have a dedicated trading professional who runs their algorithms. However, some market makers employ an approach that is not regulate and may use tactics such as ramping. These are tactics use to make it appear that a buyer or seller is a larger player in the market. When a buyer or seller appears to be a bigger player, other traders will feel compelled to front-run them, which can result in losses.

Wider Range Of Investors

A good market maker will also have the resources to accommodate a wider range of investors. Specifically, this includes institutional investors and large families. Moreover, these market makers are able to absorb big orders without escalating volatility.

The success of any token will depend on the level of liquidity in the market. Having a sufficient supply of liquid tokens will allow you to sell or buy them at any time and will also enable you to take advantage of low-risk transactions. If your token is less liquid, you are more likely to need a paid market maker to maintain liquidity.

Conclusion

The best way to determine the quality of a market maker is to investigate its reputation. As well, inquire about its strategies, as these can be vital in helping to determine a healthy, liquid market.